Depreciation Reports, Part 1: The benefits of a 30 year maintenance plan

To best enjoy the freedom and convenience of your condo lifestyle means being comfortable with your building’s current condition as well as the scale, schedule, and financing of upcoming work. Getting hit by a surprise special assessment (read about Strata financing) isn’t fun, especially if it means one less vacation that year. Your best response to a special assessment is ‘I knew this was coming and have money set aside for it. Let’s get the work done.’

It’s important to emphasize that our BC real estate system is Buyer Beware, the onus is on you to ensure the condo you’re considering is ‘the one.’ Gaining a complete picture during due diligence typically involves delving into strata documents, a professional inspection, plus other prudent investigations such as reviewing whether the view will remain intact (read more). You’ll collate all the information and then decide whether to proceed with the purchase.

Your realtor’s role is to help you make sense of all the information but you make the ultimate decision. It’s your money and home, it only matters if it’s right to you.

All buildings require maintenance, not having a Depreciation Report doesn’t mean the work disappears. It can mean that some buyers disappear, owners aren’t financially prepared, and lacklustre building maintenance.

Within the sea of strata documents, a Depreciation Report will rise to the surface with valuable information about the condition of the building. This blog outlines those Reports as well as their value to buyers and owners. A subsequent post will have suggestions on how to persuade a reluctant Strata Corporation to get one done.

What is a Depreciation Report?

Acknowledging nearly every Strata Corporation (condo development) was underfunded for future maintenance, in 2011, the BC Provincial Government made Depreciation Reports mandatory unless 75% of owners vote against one each year. I pulled the following definition from the BC Government website (www2.gov.bc.ca):

‘A depreciation report tells a strata corporation what common property and assets it has and what are the projected maintenance, repair and replacement costs over a 30 year time span; The depreciation report helps strata lot owners to protect their homes and investments and provides valuable information to prospective purchasers, mortgage and insurance providers.’

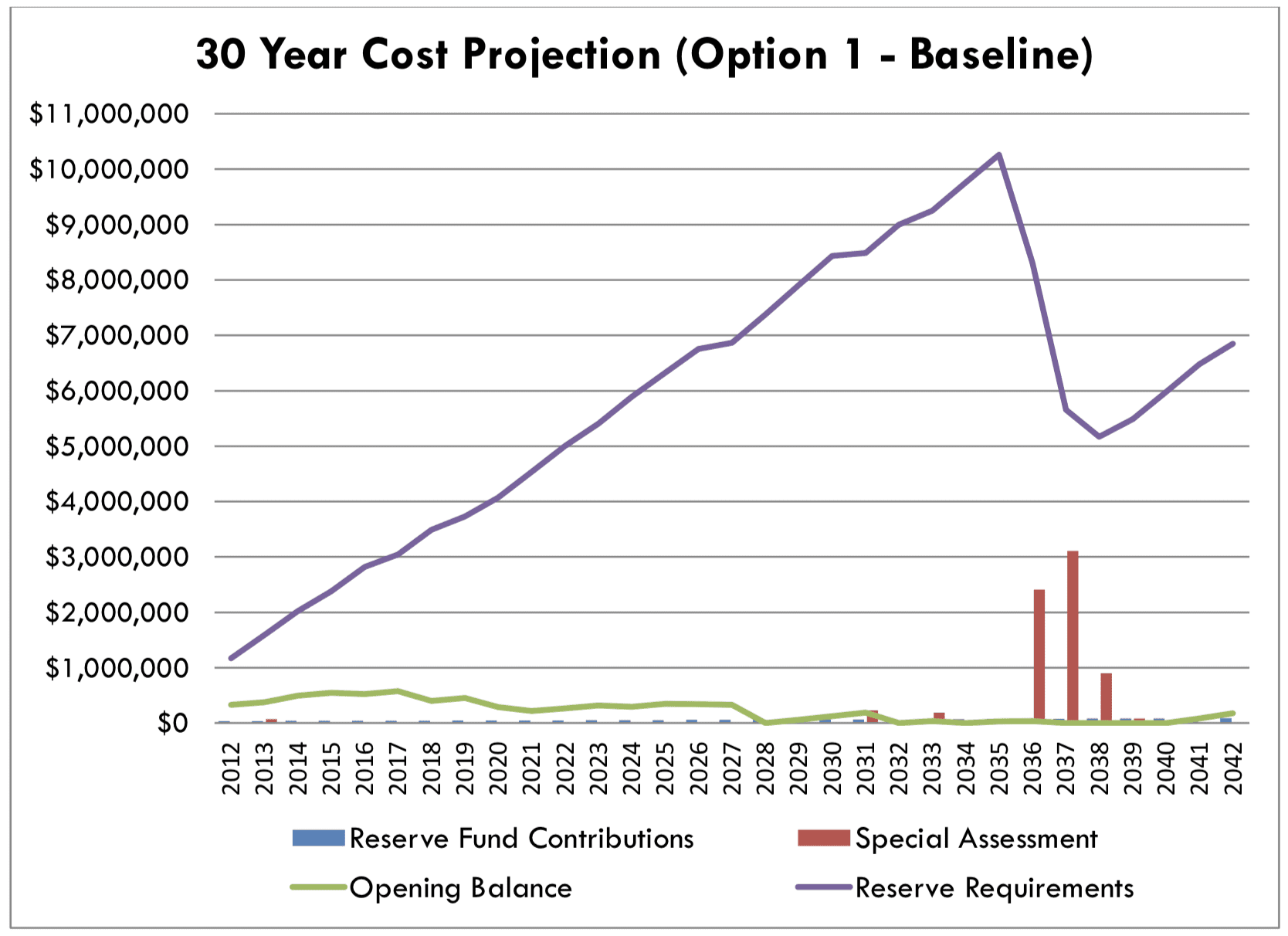

In addition to an overview of building components, each Report will also have a financial forecasting section. The latter section will help you estimate the schedule and size of any special assessments.

The BC Government requires the Reports be updated every 3 years, but again, revising the Report can be postponed if 75% of the owners agree. This vote, usually at the Annual General Meeting, must occur every year it is to be delayed.

How does a Depreciation Report benefit buyers?

In reviewing a building, it’s important to understand the current condition of the building, upcoming projects, how the work ties into the financial health of the Strata Corporation, and, ultimately, how all of that aligns with your goals. You should also appreciate the limitations of these 30 year plans and have appropriate contingencies.

As example considerations, I’ve extracted the following tips from the guidance document I provide to my clients:

- Do they have a Depreciation Report? If not, why not?

- What are the major building components?

- Are recommendations regular maintenance or part of a larger issue?

- Do issues linger and worsen before being remedied?

- When are major expenses anticipated?

- What do the 3 funding models indicate? (Have to find out which model they are following.)

- What would be your estimated portion of any special assessments?

- Do the owners support proactive maintenance and have the necessary financial ability?

You deserve professional service from your realtor: while you don’t pay it directly, your realtor will receive a substantial fee (outlined here) and it should be commensurate with the service you receive. You deserve better than having a pile of unsorted strata documents dumped on you via email and a subsequent text asking “Looks good to me, what do you think?’ Strata Corporations have a wide range of documents and, without guidance, it’s easy to become confused.

My service includes organizing the strata documents so clients don’t have to muddle through them. I include tips on what clients should note in each document to streamline and focus their review. I review all the documents and provide each client with a 50+ point written review of my thoughts in relation to their goals. If helpful, we then meet to review all of our due diligence so they can decide whether it’s the right property for them.

Some of my clients only read my 50+ written summary instead of all the strata documents. While I recommend everyone read the strata documents, it shows their trust in my service.

My services best match busy professionals buying/selling condos in downtown Vancouver or nearby. Even if you and I aren’t the right fit, this is still the service you deserve and should demand from your realtor.

How does a Depreciation Report benefit owners?

Proactive building maintenance benefits each and every owner, regardless of whether they soon plan on selling. The issues in a poorly maintained building compound over time and consume far too much time and effort of owners.

The numerous benefits to owners of having such a 30 year plan include:

- Better understanding of the scope and schedule of building maintenance.

- Having a longer time period to prepare to pay any special assessments.

- Being able to work together to find a balance between monthly maintenance fees and upcoming special assessments. When a building first receives a Depreciation Report, I have found owners typically choose to increase the monthly maintenance fees to reduce the frequency and amount of future special assessments.

- Not deferring work so it worsens or impacts insurance rates.

- Being better able to plan projects makes it easier to secure reputable contractors.

- Demonstrating the building is well managed broadens its appeal to buyers, insurance providers (read about changes to strata insurance), and mortgage lenders.

I hope this sheds light on an important part of your due diligence. Further advice… even though I love planning and forecasting, I find a coffee or two help when doing a deep dive into strata documents.

As always, I welcome your questions or comments via email or phone/text.

Best,

Jason Hutchison

604.314.7138 [email protected]