Downtown Vancouver Condo Report for February 2020 – A story like my dating life… hot and cold

The general real estate statistics you hear quoted in the news make me cringe as they don’t specifically apply to anyone. Contributing to the sea of ambiguity, the recent REBGV market report says it’s a good time to sell. As you’ll see below, it certainly isn’t a good time to sell ultra-luxury condos. There’s almost always more than one market going on in Vancouver. If you’re buying a $1.5m two bedroom condo in Yaletown, it doesn’t much matter to you what $4m houses are doing in Kerrisdale.

To make informed decisions, you need to understand what the market is doing specifically for your neighbourhood, home type, and price point.

Even within the 4 neighbourhoods within our downtown peninsula (Downtown, Yaletown, Coal Harbour, and the West End) there’s nearly always more than one market. Currently, as a whole, the downtown peninsula is a Sellers Market, however, there are substantial differences tied to price. Condos up to $1.25m are very active, those falling within $1.25m-$1.5m show a little life, and condos priced above $2.25m are essentially dead.

Potential strategies in response to market conditions

Speaking of generalities… below are very general strategies you can consider to start plotting your best path forward. Your actual approach will be a melding of your personal goals and market conditions, and a contingency plan is a healthy idea. Once you identify your overarching goals, how that best slots into our market becomes readily apparent.

Up to $1.25m: this segment strongly favours sellers. In selling, you may want to be on market for a week before reviewing offers in hopes of fostering competition. In buying, it may be advantageous to complete your due diligence (read more here) ahead of submitting your offer to make it more appealing to the seller.

$1.25m-2.25m: overall, buyers have more time to make decisions but be aware that good properties still sell quickly.

Above $2.25m: this is challenging segment for sellers, partially due to some buyers being content to see if prices further drop.

I’m happy to discuss our market in relation to your home selling and/or buying goals. Feel free to reach out call, email, text, or we can enjoy a relaxed chat over coffee. cell: 604.314.7138 email: [email protected]

The below sections expand upon the above summary.

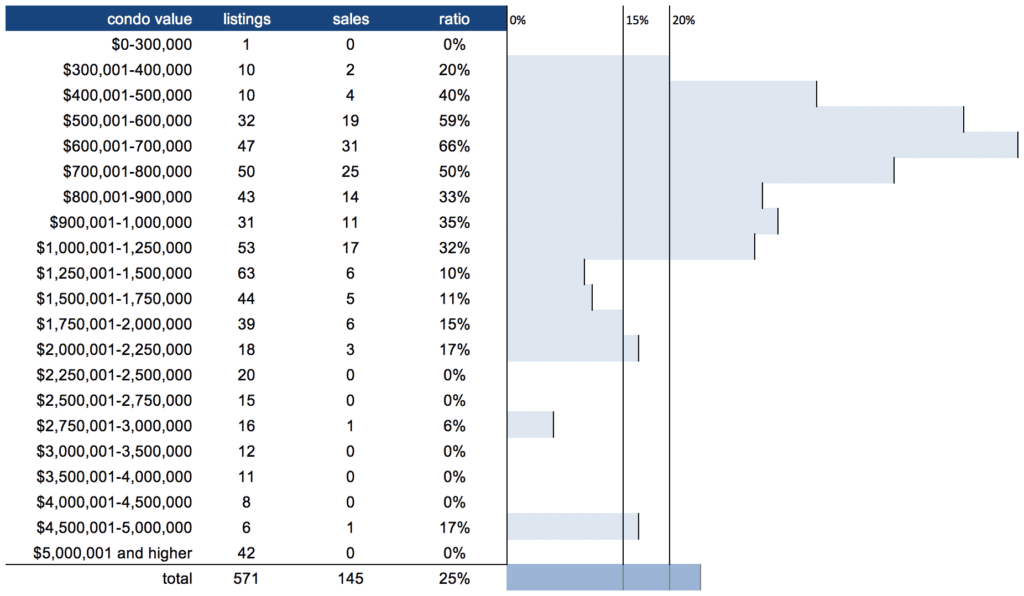

Listings and sales by value

Price segments: The higher the sales ratio (%), the more active the price band. At a 25% sales ratio, the February 2020 market across all 4 neighbourhoods and price points was a Sellers Market but that approach flattens data and misleads. Condos below $1.25m were very active while those between $1.25m and $2.25m showed a little life. Market activity above $2.25m was dismal.

Market classifications: To the right of the data table I’ve delineated between a Buyers (0%-15% sales ratio), Balanced (15%-20%), and Seller’s (21% and over+) Markets to provide context to the sales ratios but please note that it’s not entirely accurate to do so. For instance, although the $4.5m-5m market segment is shown as a Balanced Market, it doesn’t mean prices are stable as with a general Balanced Market. Applying a wider lens indicates prices would more likely be falling. Typical market characteristics are outlined below in Market Characteristics and Direction.

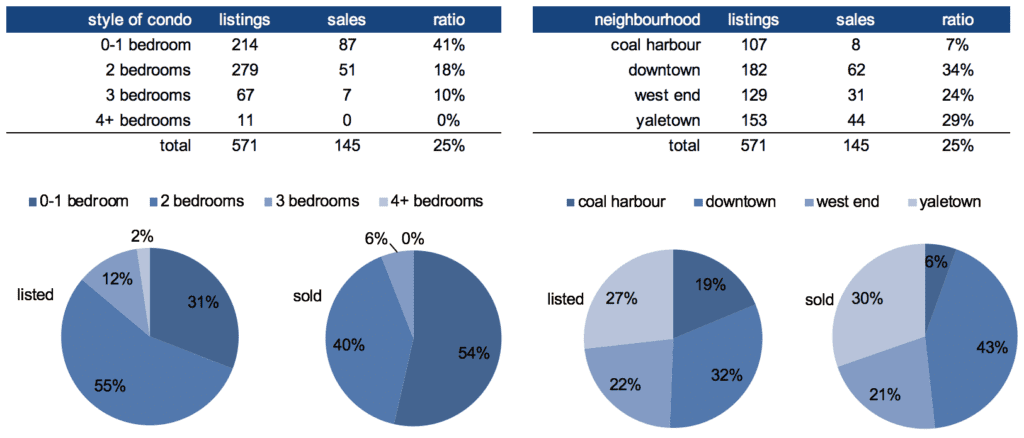

Listings and sales by style of condo and neighbourhood

Condo types – as typical, smaller condos were the most active. Two bedroom condos were stable while 3+ bedroom condos were very slow.

Neighbourhoods – Downtown was the busiest neighbourhood. Given the prevalence of luxury and ultra-luxury condos in Coal Harbour and the lacklustre performance of such condos, it’s no surprise that Coal Harbour was the slowest neighbourhood.

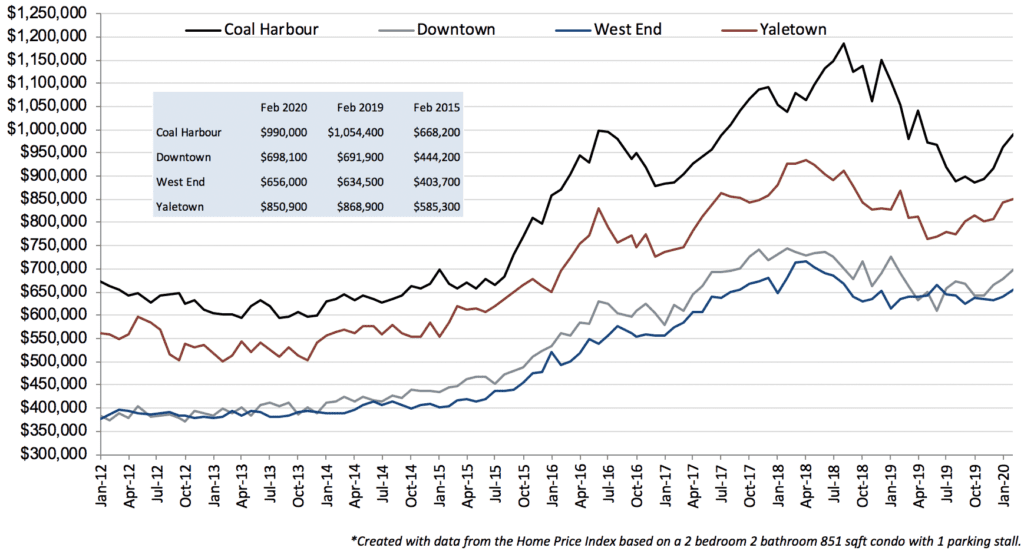

Graph of Home Price Index benchmark condo values

The above graph is based on data from the Home Price Index (HPI), a computer model used to determine the value of a typical 2 bedroom condo. The number wizards consider the HPI to be less susceptible to outliers such as ultra-luxury condo sales than the arithmetic average and median.

Condo values – overall, condo values appear to have stabilized. Coal Harbour shows a strong bounce back but we’ll have to wait to see if that new plateau is sustained.

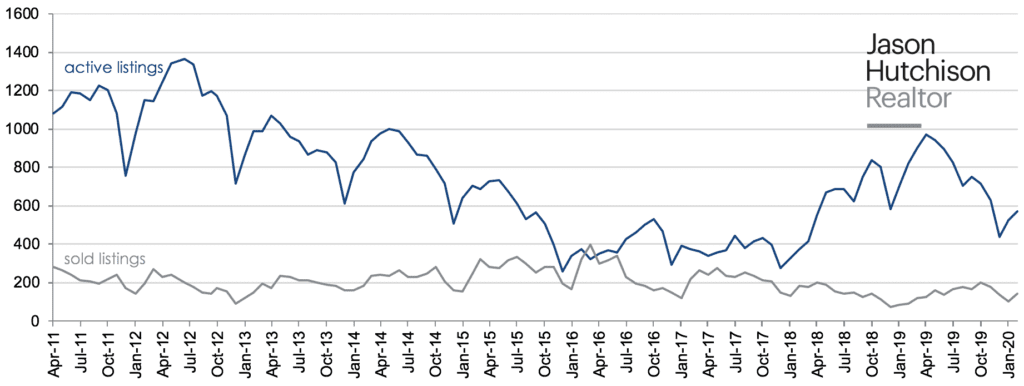

Trend in number of active and sold listings

Listings – adhering to tradition, the number of listings experienced an uptick from December. As we move into spring, we should see the number of listings progressively improve as it is traditionally our busiest market of the year.

Sales – sales were stronger than January 2019 but still within a reasonable amount.

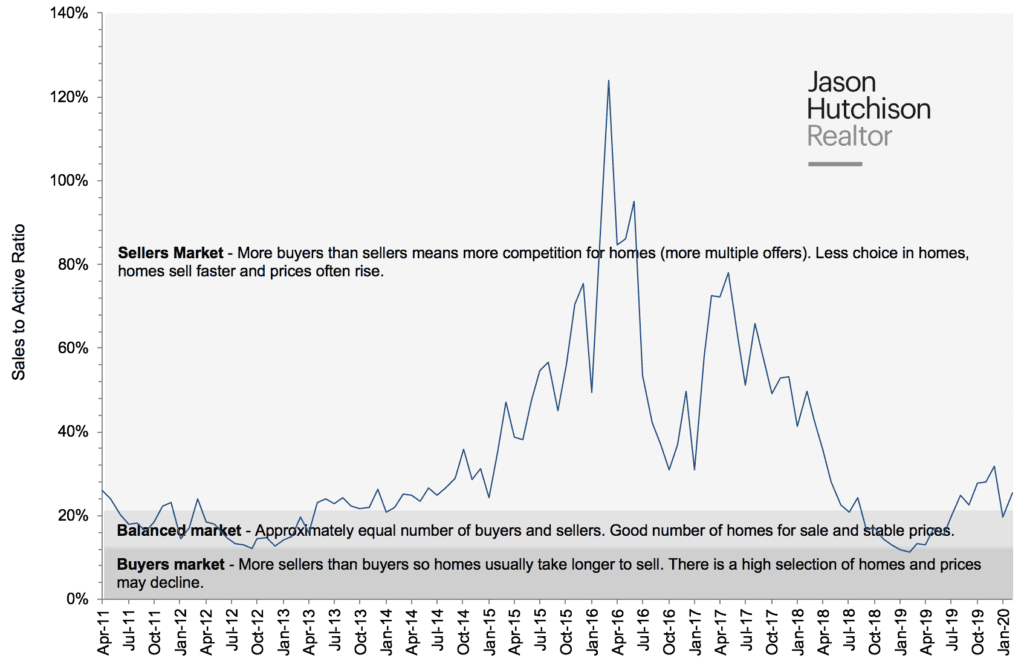

Overall market characteristics and direction

Current market – viewing the downtown peninsula condo market as a whole, February 2020 reported a 25% sales ratio, firmly a Sellers Market. However, as seen above, lower price points are outperforming higher price points.

Market direction – With low interest rates, a relaxing of mortgage rules, and lack of listings, studios, 1 bedroom, and low to mid priced 2 bedroom listings are likely to continue to be very active. I anticipate ultra-luxury still has room to drop before the lower end of that scale become active. Our ultra-luxury segment is heavily dependent upon foreign buyers re-entering our market, which may not be for awhile given international events compounded by the foreign buyers tax.

I hope this was clear and useful. I welcome your questions about a particular segment of the market. Feel free to connect when convenient.

Jason Hutchison

604.314.7138 [email protected]